Joys of Compounding (Part 1)

Being a book worm, I have come across many books that I thought were stupid buys but later turned out to be one of the best investments. But the book that I am going to talk about today was nothing like what I described above. This book was an impulse buy, knowing that it was going to be one of the best books I have ever read. You would hardly come across a book that talks about investments, knowledge, trading strategies, and life lessons with the same intensity and importance. Well, if you have authors like Gautam Baid writing books, you can expect the book to be a masterclass for value investors. The book that I am going to talk about has literally one thing that the author tries to relate to various aspects of life. That one thing, my friend, is what Einstein called the 8th wonder of the world. You guessed it. The concept around which the book hovers is compounding, and the name of the book is Joys of Compounding.

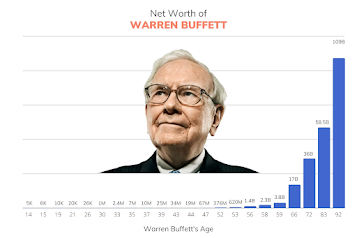

Apart from sharing love for investments, money, running businesses, eating peanut brittles, drinking coke, and driving secondhand cars, Charlie and Warren shared a common love for compounding as well. It was very early in their lives that they discovered the immense power of those little habits that compound to become giants. This book highlights the importance of compounding like no other book has ever highlighted. So, let me feed those knowledge-hungry vultures inside you with some compound meat.

1. "The best investment you can make is an investment in yourself".

Talking to a group of undergraduates in Omaha in 2002, Buffett, the god of investments, was asked for an investment tip, to which he replied with his wit. He said that the best investment that anyone can make is in themselves. He said, and I quote, "In my early days, I had two things on my mind: girls and cars. I wasn't good with girls, hence I thought about cars. Imagine if a gene comes to you and grants you a wish to buy your dream car. It might be a Mercedes-Maybach or a Rolls-Royce. You wish it, and the gene will deliver you the car. But the catch is that this car will be your last car, and you will have to use it till the very end. Imagine how much care and attention you will give to that car. You might change the oil every quarter, or you might clean it every second day, or you might drive it below 50 km/h just to keep it safe from scratches.

Now, you are not going to get just one car in your life, but you are going to get just one brain and one body in your lifetime. And that's all you are going to get. The mind and the body feel terrific now, but it has to last throughout the lifetime. The state of your mind and your body 50-60 years down the line will be the reflection of small habits that you inculcate right now. Invest in yourself and invest now.

2. "Read, read, read".

Apart from having an unmatchable wit, the late Charlie Munger was famous for his love affair with his books. He was often called a book with two legs. His grandchildren also accused him of spending more time in the library than playing around in the garden with them. Well, it did pay off. Reading is one of the most useful investments that pays the highest dividends. Charlie once said, and I quote, "I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up, and boy does that help, particularly when you have a long run ahead of you.".

On an annual basis, Warren Buffett writes a shareholder letter to his investors. In a 2014 letter, Munger outlined his expectations of the chair of the firm: "His first priority would be reservation of much time for quiet reading and thinking, particularly that which might advance his determined learning, no matter how old he becomes." Self-improvement is the ultimate form of investing in yourself. It requires devoting time, money, attention, and hard efforts now for a particular payoff later, sometimes in the far distant future. As he began his investment career, Warren would read 600, 700, or 750 pages a day. Reading 500 pages a day might not be feasible for you. If, however, you can find ways to read during the day, at night, or on the weekends, you are likely to see multiple benefits. As Charlie once said, "The game of life is the game of everlasting learning."

3. Good people, good life.

"Good teachers, in any field, do far more than convey information; they pass along something of themselves." No one else can relate to this statement by Peter Buffett (Warren's son) as much as I can. I have seen how the presence of bad teachers can almost ruin your life and how the presence of good and selfless teachers can transform your life. People who constantly strive to improve themselves usually have a role model. This is a crucial aspect in the journey of self-improvement. As creatures of comfort, we are reluctant to step out of our comfort zone, and we often lack the inner urge. Books are priceless sources of wisdom, but people are the ultimate role models, and there are lessons that we can only learn from observing them or being in their presence. In many cases, these lessons are never communicated verbally.

Throughout my childhood, I was a weak student. I finished my boards with decent grades. It was only my subsequent awakening, driven by a major personal setback, that made me finally realize the virtues of hard work and determined efforts. If you can dedicate yourself and commit, you can learn anything. To be a winner, work with winners. One of Berkshire's biggest strengths has been the group of managers running its subsidiaries and hitting the home runs in the form of profitable growth with high rates of return. Nothing, nothing at all matters as much as bringing the right people into your life. They will teach you everything you need to know. Surrounding yourself with smarter and better people provides a great education. Surrounding yourselves with idiots also provides you with the education of not doing certain things. The people closest to you play an outsize role in your level of success or failure, so choose wisely. You are, after all, the average of the five people you associate with the most in your life.

4. Deserved trust is earned.

Of all forms of pride, perhaps the most desirable is a justified pride in being trustworthy, says Charlie Munger. Trust lies at the heart of all relationships. In answer to the question "What is trust?" Jack Welch, the former Chief of General Electric, replied, "You know it when you feel it." We experience an echoing, anxious feeling when trust is not present. In such cases, we hesitate to take the next step. Conversely, when trust is present, we experience an open, connected feeling. We build trust by being honest in our communication. By being transparent, admitting mistakes, and sharing what we learn. In his speeches, Munger often used to list reliability as one of the essential traits for success. He explains that, although not many people can learn something like quantum mechanics, anyone can learn reliability.

Woody Allen said that 80% of success in life is just showing up. Always reliably show up for the task entrusted to you. Never overpromise and underdeliver. Being unreliable will impair your career and friendship. If anything, under promise and overdeliver. Trust is earned when actions meet words. Laurence Endersen writes in his book Pebbles of Perception, "Our ability to choose is one of life's great gifts. We are the product of our choices. Good choices come from good character, and a few good choices make all the difference." Being reliable and trustworthy is one such choice.

5. Humility is gateway to Heaven.

According to Confucius, real knowledge is knowing the extent of one's ignorance, and this sentiment has been expressed by many philosophers, in one form or another. Socrates, for example, put it quite bluntly when he said, "Only if we approach learning with an open mind can we truly educate ourselves." The wiser we become, the more we realize how little we know. A lesser-known equation from Albert Einstein rings true: "ego = 1/knowledge." More the knowledge, lesser the ego; lesser the knowledge, more the ego." Always question what you think you know, and remember that every subject is probably more complex than we currently recognize. Such self-awareness creates a more accurate mental map of reality, which in turn results in adopting language that more closely reflects the nuances of the world. You get the idea. We never can be fully sure.

6. Achieving financial independence.

You thought I wouldn't talk about money? Truth is hard to assimilate when it is opposed by interest. You cannot really understand how the world truly works unless you have financial independence. Once you achieve this state, it changes everything. It enables you to look at reality in a truly unbiased manner. The goal of financial independence is to stop depending on others. True wealth is measured in terms of personal liberty and freedom, not monetary currency. Money alone cannot signify independence. The only definition of success is being able to spend your life in your own way.

"When I was young, I read The Richest Man in Babylon, which said to underspend your income and invest the difference. Lo and behold, I did this, and it worked' - Charlier Munger. The first step to financial independence is to live within your means. Underspend your income to the maximum extent possible. Avoid taking on any debt for discretionary consumption. Cook at home. Buy clothes only on sale. Learn to cherish frugality. Read The Way to Wealth by Benjamin Franklin, The Richest Man in Babylon, and The Millionaire Next Door by Thomas Stanley and William Danko. Invest wisely by learning from great investors, or be my client.

Building wealth over time has less to do with your income levels or investment returns and more to do with savings discipline. "In the long run, it's not just how much money you make that will determine your future prosperity. It's how much of that money you put to work by saving it and investing it." Because you can build wealth without a high income but have no chance without any savings, it is pretty obvious which one deserves a higher priority.

7. Inner scorecard Vs Outer scorecard.

To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment, says Ralph Waldo Emerson. According to Warren, there are only two types of people in life: those who care what people think of them and those who care how good they really are. He always remains true to himself and never compromises on his values. He has never cared about luxurious possessions, and he still lives in the modest house he bought for $31,500 in 1958. As an investor, Buffett thinks entirely for himself and invests only according to his personal investment philosophy.

During 1999, in the midst of the internet bubble, Buffett was being humiliated by some of the leading financial commentators of the time, and Berkshire's stock price was getting hammered. But Buffett always kept in mind what he had been taught by his father—that the only scorecard that counts is your inner scorecard. My father also said the same thing, but being a Marathi-speaking household, he said it using a beautiful proverb that goes like, "लोकांच्या मंहण्या ने आपल्या अंगाला भोका पडत नाही." Don't live a life based on approval from others. Be authentic. Act in accordance with who you are and what you believe in, or one day your mask will fall off. If Buffett was living by the standards others followed, he would not have been able to maintain the firm independence of mind that has helped him avoid many financial bubbles and the subsequent personal misery. It is a significant lesson for all those contrarian investors. A contrarian isn't one who always takes the opposite path just for the sake of it. That is simply a conformist of a different sort. A true contrarian is one who reasons independently, from the ground up, based on factual data, and resists pressure to conform.

With that, I have nothing left to add. The book has a boatload of information that is very difficult to sum up in one blog. There are limitations to how much I can type and how much you guys can read. Hence, this is going to be part 1 of 2 blogs on the same book. I would like to end the first half with an interesting question from Buffett himself. "Would you like to be the best lover in the world and known as the worst, or would you like to be known as the best and actually be the worst?" If you know how to answer the above question, pat your back because you are truly living your life from the inner scorecard.

Stay tuned for the second part on the same blog. Till then,

Happy Investing.

Comments

Post a Comment