Buffett's Guide to Economic Moats.

Capitalism is brutal. To stay competitive in the long term, a company needs to have an enduring competitive advantage, or an economic advantage. The term "economic moat," popularised by Warren Buffett, refers to the ability to maintain a competitive advantage over its competitors in order to protect its long-term profits and market share. Just like a mediaeval castle, the moat serves to protect those fortresses and their riches from outsiders.

Remember, competitive advantage is essentially any factor that allows a company to provide a good or service that is similar to those offered by its competitors and, at the same time, outperform those competitors in profits. A good example of a competitive advantage would be a low-cost advantage, such as cheap access to raw materials. Very successful investors such as Mr. Buffett have been adept at finding companies with solid economic moats but relatively low share prices. For us investors to find a company with an enduring competitive advantage, we need to have an idea of how to identify one.

Here are nine financial "rules of thumb" that Mr. Buffett uses to tell if a company has one:

1. GROSS MARGIN:

On the income statement, gross margin tells us about the profit margin after realising the cost of goods sold and before expensing expenses like taxes. A company that has a competitive advantage should have a gross margin of at least 40% or more. A consistently high gross margin shows that the company doesn't have to compete exclusively on price. It also provides ample gross profit to pay expenses and leave money for shareholders.

2. SALES, ADMINISTRATIVE, AND GENERAL EXPENSES:

On the income statement, sales, administrative, and general expenses constitute a big chunk of a company's income statement. In order for a company to have a "most", their sales, administrative, and general expenses should not exceed 30%. Wide-moat companies don't need to spend a lot on overhead to operate. No moat business does. Buffett looks for companies that consistently spend under 30% of their gross profit on SG&A.

3. DEPRECIATION EXPENSE:

On the income statement and the cash flow statement, depreciation expense is a form of non-cash expense that is charged on tangible assets. According to Buffett, depreciation expenses should be consistently under 10%. If depreciation expense is consistently under 10% of gross profit, it's a sign that the company doesn't need a lot of capital expenditure assets to maintain its competitive advantage and has a moat. Companies that consistently need to incur capital expenditures show that they are inefficient in using their existing assets to generate revenues and hence need to purchase assets, which eventually will increase their depreciation charges.

4. INTEREST EXPENSES: On the income statement, interest expense is one of the most critical expenses. A company that has a competitive edge should have interest expenses that are not more than 15% of their gross income. Buffett says that great businesses have such amazing economics that they don't need debt to grow. This number varies greatly by industry. But it's a great sign if a company consistently spends less than 15% of its operating income on interest.

5. INCOME TAX EXPENSE:

On the income statement, a company should consistently pay the full amount of taxes. Wide-mouth businesses make so much money that they are consistently forced to pay their full share of taxes. There is no need to avoid taxes, as cash from operations is sufficient to generate cash. Contradictorily, companies that have consistently negative or erratic income tax bills aren't as likely to have a durable most.

6. PROFIT MARGIN (NET MARGIN):

On the income statement, a company should have a profit margin of more than 20%, and a company that has a profit margin below 10% is a negative sign. Companies that consistently convert 20% of their revenue into net income are likely to have a moat. If this number is under 10%, negative, or volatile, it's an indication that competition is fierce.

7. CAPITAL EXPENDITURE: On the income statement and the cash flow statement, capital expenditure eats into profit. Companies that don't have to spend a lot on capital expenditures have more money to reward shareholders. Capital expenditures can vary greatly from year to year. Averaging the result over 10+ years is best.

8. TOTAL LIABILITIES TO ADJUSTED SHAREHOLDER EQUITY:

On the balance sheet, this ratio can be calculated by dividing total liabilities (money owed by the company) by total shareholder equity (our money). A ratio below 0.80 indicates that the liabilities are under control and can be paid using shareholder equity. Buffett's logic 0.80 is that large companies finance themselves with profits, not debt. However, stock buybacks can throw off this equation. Adjust for this by adding back Treasury stock to the shareholder equity number.

9. RETURN ON SHAREHOLDER'S EQUITY:

Found on the income statement and the balance sheet, ROE shows how efficiently the company is using shareholders' capital. ROE above 15% indicates efficiency in the use of capital, whereas ROE below 10% indicates inefficiency in the use of capital. ROE shows how effectively management is reinvesting its profits. A number consistently over 15% indicates that the business has a moat.

3 THINGS TO CONSIDER:

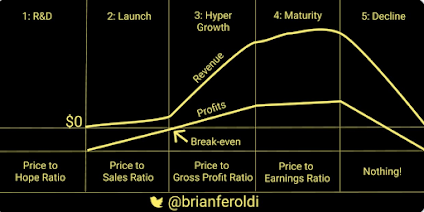

1. These "rules of thumbs" are only useful when a company is fully organized for profits. Many if them don't work at all when a company is in phases 1,2,3, or 5.

2. CO NSISTENCY IS KEY: The real test is if a company generates good numbers over multiple years and various economic cycle.

3. There are plenty of exceptions and nuances to these rules. Many of Buffett's largest holdings do not pass every rule of thumb. That's because investing and accounting have tons of nuances. Still, rule of thumbs is very helpful.

Comments

Post a Comment